Bull & Bear Markets — Beginners' Guide

José Oramas

2 Aug 2021

•

6 min read

Cryptocurrencies, real estate, equity, and all kinds of markets out there may have their differences when it comes to asset volatility, market study, and approaches, financial and technological developments, etc. But two things that apply to all of them are bearish and bullish periods —something key when it comes to market analysis.

So how can we define these periods where markets are tagged as “bullish” or “bearish.” It’s quite simple. First, let’s keep in mind that these terms apply to all kinds of markets.

Defining Bull Markets##

When investors say a market is “bullish,” it means that most assets are surging in price gradually, and direction usually favors traders in the long run. Bullish periods are usually larger than bear markets. These periods are never straightforward —fluctuation still remains, and we can notice that in charts.

Throughout history, there have been many bull markets we can observe and learn from. The stock market is always cyclical, so we can witness phases of prolonged rises (bull markets) and phases of continuous falls (bear periods).

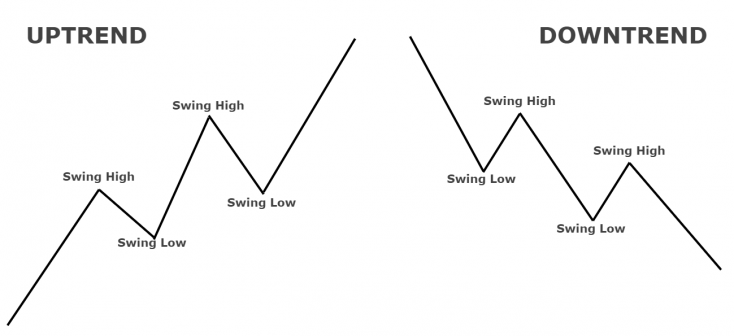

When we see these charts, we can notice two things, a large line of candles —which we’ll call swing highs— followed by a small pullback, which are short price fluctuations called swing lows.

Examples of Bull Markets#

One example of a bull run is the crypto market during the economic recession of 2020. But let’s put things in perspective first

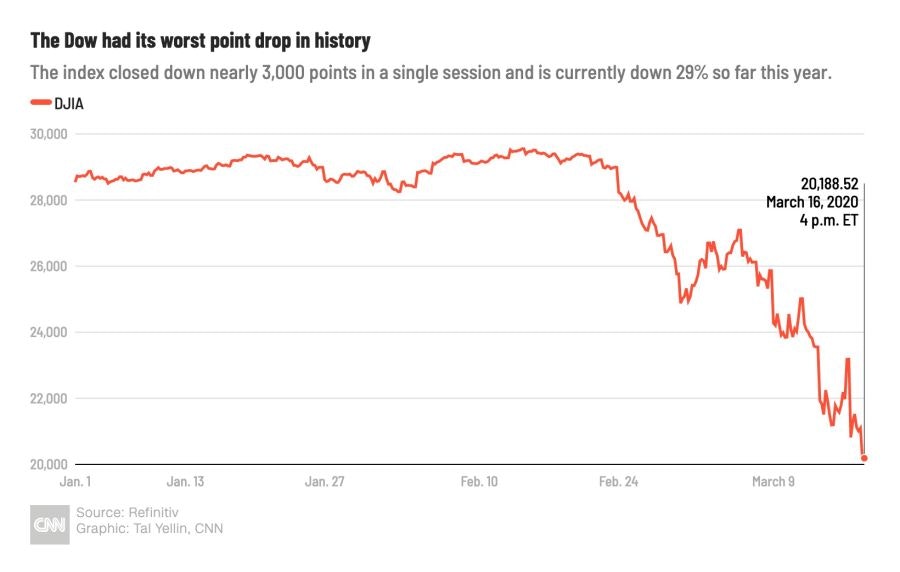

During the early months of 2020, the COVID-19 outburst shook the world’s economical stability —or what was left of it—, causing one of the worst economic recessions in history. The virus spread, hospitals were full of sick people, the entire world simply stopped, and millions of small to mid-size businesses were affected due to the extreme lockdown measures. Governments, trying to stabilize their economies, ordered their respective central banks to print more money, attempting to save what they could of their countries. The stock market crashed, and most investors were worried about upcoming fiat hyperinflation considering the number of printing banks were doing back then.

Retail traders and investors started losing tremendous amounts of money in a time where most assets were going downhill, and the constant pressure from global economists and medical organizations only worsened the sentiment of fear around the market. Attempting to recover from their massive losses, investors started seeking alternative assets that could work as a safe store of value, fearful of fiat hyperinflation and the declining purchase power of the American dollar.

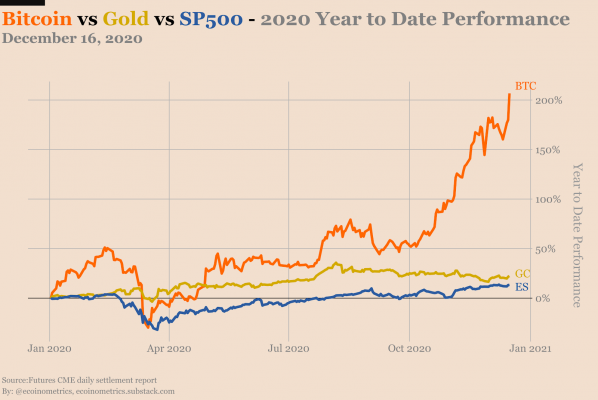

This is where cryptocurrencies started to seem like those alternative assets that could save investors’ portfolios —however, it came with a grain of salt. Most traditional investors were wary about entering the crypto market. It wasn’t until institutional capital came in and billionaires like Paul Tudor Jones or Stanley Druckenmiller highlighted the benefits of cryptocurrencies and the decentralized finance sector. Soon, hedge fund managers, investment bankers, institutional investors, started realizing the importance of digital assets in their clients’ portfolios.

2020 was called “the institutional bull run” for the crypto market as more and institutional investors and traditional financial companies wanted to embrace digital assets. We could name a few: PayPal offering custody and crypto payments through crypto to fiat conversion, investment banks offering clients exposure to BTC, payment processors like Mastercard or Visa announcing partnerships to further expand crypto adoption, and more.

It all fell in place as the lockdown had people staying in their homes and doing nothing but spending time with their families or on the internet. E-commerce skyrocketed —over 2 billion people in 2020 started purchasing goods or services online, boosting e-commerce sales to over $4.2 trillion.

The need for physical money started dissipating as people were paying on their favourite online stores with digital money, reinforcing and highlighting the benefits of cryptocurrencies. As soon as crypto and blockchain adoption took off, the market reached over $2 trillion in market capitalization in May this year.

The leading crypto during this bull run was, of course, Bitcoin. BTC was priced at slightly above $7,000 by January 2020, but as soon as institutional capital flocked to the market, BTC was already breaking the unfamous psychological barrier of $20,000 by mid-December. Meanwhile, the stock market wasn’t performing so well.

Defining Bear Markets##

In a bear market, most assets are in a downtrend. Just like in a bull market, we’ll have to identify key factors in order to not enter that market during a false price reversal. Within bearish markets, demand is low and supply is big. Most investors would look at a bear market and call it as such if it loses over 20% from recent highs.

During bearish markets, most assets create a succession of decreasing highs and lows, just like we saw for bullish markets, but we have higher highs and higher lows.

In a bear market, assets move in a downtrend for a period that could last several months or years. Let’s see some of the characteristics of a bear market:

- Most assets fall in price

- Investors’ sentiment is mostly negative

- Bearish runs are usually shorter than bullish runs but are also more abrupt and volatile.

Examples of a Bear Market#

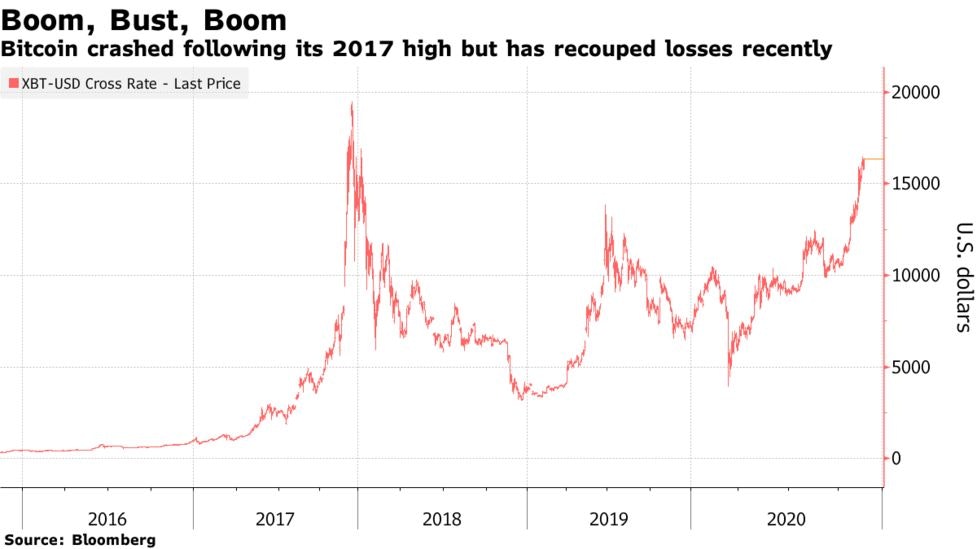

Bitcoin has surged over 9000% since 2015, but it doesn’t mean it hasn’t suffered harsh price corrections or crashes. Bearish runs are not as long as bull runs, as we said before, but they are more impactful, and the same thing —and even worse— applies to the crypto market. We could mention BTC’s bearish run in 2017, which extended to mid-2019.

Many members of the crypto community would argue that the market is on a bearish run now — institutional capital is drying, adoption is slowing down, interest is low, and fear has shrugged investors. Whether or not we’re in the final stages of this bearish run, large token holders and miners are seeing this as an opportunity to buy more.

The Crypto Market##

There is something we need to consider. While most definitions and tools we see here can apply to every market out there, the crypto market is inherently more volatile.

The crypto space attracts retail investors for many reasons: financial and technological innovation, hype, high returns, etc. Here, a market crash can occur overnight and most investors would get their positions liquidated —especially weak hands.

Bitcoin has been subject to fluctuations caused by miners being kicked out of China due to energy consumption, to a single tweet or comment from famous billionaires. There are, however, tokens that are drifting away from Bitcoin’s chaos and the mainstream, maintaining a steady price and surging over time as they are part of a bigger project of the decentralized finance world.

Supply and Demand#

BTC has a current market capitalization of $645 billion. How do we get this figure? By looking at the current coin circulation multiplied by the current worth. We multiply these two in order to get an asset’s market cap. It’s the same for equity and traditional markets, we’ll just call them outstanding shares multiplied by the current share price.

Bitcoin’s maximum supply was limited at 21 million, and the current supply sits at 18,77 million coins. As adoption takes off and institutional capital flocks to the crypto market, the higher the price. Why? Because of demand. Simple as that. If the illiquid supply is greater than the liquid supply, the price goes up.

Who controls the supply? Large holders —they control 75% of it. According to on-chain market intelligence site, Glassnode, large token holders started accumulating big amounts of BTC a few weeks ago while BTC was hovering around 30k. This, of course, suggests that whales (as they are called) are preparing for the next bull run and take their profit again, shorting the supply.

HODLers

If you’re familiar with the crypto space, you have heard the term HODL before. If you haven’t, it refers to investors that hold their funds even when dramatic price drops occur. Hence, we have two terms: “Weak Hands” —traders who usually do panic selling, and HODLers —traders who refuse to sell despite market corrections or crashes. It’s also an acronym for “Hold on for Dear Life.”

HODLers aren’t easily shaken by abrupt price movements —they rather see it as an opportunity to stack as many coins as they can and profit when the next bull run starts. Let’s take Bitcoin, for instance. When BTC price suffers a harsh price drop, the two people that rush in to buy are Bitcoin maximalists and miners. However, they usually compete for block space during bull runs.

When weak hands are triggered, coins are sold, and large token holders, miners, and maximalists will do everything they can to stack those coins. Why? Because the crypto market has a limited supply of coins, unlike fiat currencies that central banks can print infinitely.

Analyzing Markets##

Technical analysis is the study of market movements —mainly through the use of charts with the purpose of identifying future price trends. When we talk about market movement, we need to consider the only three things available for a trader: price, volume, and open interest. What we try to figure out is that price movement should reflect supply and demand changes —if demand overpasses supply, prices go up, if supply surpasses demands, prices go down.

Momentum is key in order to identify a possible trend reversal, and properly identifying trends is absolutely essential for traders. The only purpose of graphic representations of markets’ price movements is identifying trends in their early stages with the purpose of entering a market through a good window of opportunity and going with the trend —never against it.

Closing thoughts.##

No matter what market we’re talking about, understanding trends and the nature of a specific market —along with a good set of tools— can help us understand what the market is doing and where it wants to go.

The same concepts apply to each of them, the only difference is the approach.

Sign up to Blockchain Works for more blockchain news and resources!

José Oramas

Fintech and finance writer, with keen interest in blockchain and crypto.

See other articles by José

WorksHub

Jobs

Locations

Articles

Ground Floor, Verse Building, 18 Brunswick Place, London, N1 6DZ

108 E 16th Street, New York, NY 10003

Subscribe to our newsletter

Join over 111,000 others and get access to exclusive content, job opportunities and more!