What is Binance Smart Chain (BSC)?

José Oramas

28 Jun 2021

•

6 min read

What is Binance Smart Chain (BSC)?

Binance Smart Chain —BSC— is a blockchain system from the crypto-trading platform Binance. BSC is designed to provide a high-performance infrastructure for decentralised trading, building dApps, interoperability between other blockchains, and support of smart contracts and other DeFi products.

Launch

BSC was unveiled in April 2019, going live on mainnet in September 2020. The Binance community had the idea to create a cross-chain network where users could benefit from the high throughput of the Binance Chain and the smart contract compatibility of BSC.

How BSC Works

Let’s get to know the Binance Chain (BS) first. This network is the home of BNB (Binance Coin) and where the community exchanges, issues, and trades digital assets in a decentralised manner with high throughput.

Binance Smart Chain came to expand Binance’s reach to DeFi developers looking for an efficient and high-performance network.

- Full Compatibility with Other Blockchains

BSC is not a build-off but a dual-chain system that supports many features of the DeFi universe, like asset swaps between other blockchains and full support for smart contracts. You could think of BSC as a complementary network to the BC.

A feature that makes BSC an interesting choice for developers is its full programmability and compatibility to the Ethereum Virtual Machine —EVM—. This allows developers to port their projects from ETH to BSC. By implementing the EVM, BSC has access to the many tools and dApps of Ethereum, like MetaMask.

BSC leverages interoperability so users can swap a handful of assets in the network. Anyone can exchange their BEP-2 —Binance Chain technical standard— and BEP-8 —a low-cost project for small projects— for BEP-20, which is a BSC’s token standard via Binance DEX or through Trust Wallet.

- Consensus

BSC uses a hybrid consensus called Proof of Staked Authority (PoSA). This algorithm allows all participants to become validators by staking their BNB coins. PoSA can be forked and requires several block confirmations than usual. Every validator can create one block, so to verify data on the Binance Smart Chain, several blocks are needed because data can’t rely on only one validator.

BNB Token

Binance Coin is the native and utility token that powers the entire Binance ecosystem. BNB is used to pay for fees and trades on BC and BSC. It does not stop there, however. Let’s see what you can do with BNB:

-

Trading: exchange BNB with over 200 tokens on the Binance ecosystem and other exchanges, like Kucoin, Crypto.com, or HitBTC.

-

Staking: Stake BNB to commit to the network and earn rewards.

-

Delegate: Once you have staked your BNB, you can later delegate it to a BSC validator of your choice and earn more rewards in the process.

-

Hotel Booking: You can book hotels on Travala.com and pay using BNB. You can also use other cryptocurrencies like Bitcoin or AVA.

-

Paying Fees: You can pay your fees with BNB. This will give you a discount for doing so.

-

Loans: certain platforms will allow you to use BNB as collateral for loans.

Token Economics

Unlike other protocols, there are no block subsidies or freshly minted BNB because it is not an inflationary token. Inflationary tokens are continuously printed over time with no capped limit.

BNB are periodically burnt to permanently remove them from circulation once they are used to pay fees. In token economics, the idea behind burning coins is to decrease supply to increase value over time. Binance will continue to burn coins until their supply reaches 100 million —at press time, the current circulation is 153 million BNB.

BNB ICO

BNB debuted with an Initial Public Offering (ICO) in July 2017 raising over US$15 million at 15 cents per token. 50% (100 million) of tokens were distributed to the ICO while developers took 40% (80 million), and the remaining 10% went to angel investors.

Staking, Delegating, and On-chain Governance

Binance provides on-chain governance through the PoSA consensus. To participate in the community and vote in the future changes of the protocol, users need to stake their funds to be able to vote.

-

Delegation: token holders and block validators can bond their tokens into the stake. Token holders can also become validators by delegating their tokens to other validators.

-

Ranking: Bonded tokens work as a measure to rank validator candidates. The more tokens a user bonds into the stake, the more chances they have to become a validator.

-

Slashing: Slashing is part of the on-chain governance system. BSC will “slash” a validator as a punishment for bad behaviour. If token holders and validators should be punished, then it will affect their delegators as well. These bad behaviours can go from double signs, unavailability, or instability.

-

Unbound period: Tokens will remain bounded if the system detects bad behaviours. During that period, the identified subject will get slashed and “jailed” for two days and remove it from the validator set.

Where to buy BNB

BNB can be bought by registering an account on Binance or other exchange that supports BNB. Let’s take for example Binance itself.

1 — First, register an account on Binance.

2 — Once you provide the necessary info, you’ll have a variety of options to deposit. Head over to the top left of the page to a tab that says Buy Crypto.

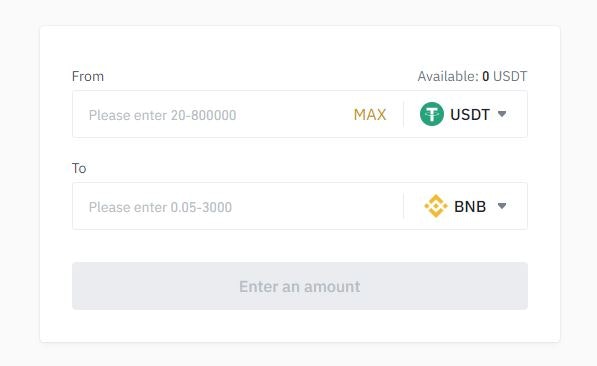

3 — Choose an option to fund your wallet. You can use: 1) wire transfer 2) credit card 3) trade another crypto for BNB and 4) third-party payments (Simplex, SEPA).

4 — Once you fund your wallet, you’ll receive a deposit in Stablecoin, which you can exchange for BNB or any other crypto.

5 — Go to the trade tab and choose BNB

6 — Select the amount of BNB you want and proceed with the trade. Your funds should be instantly added to your wallet.

Differences between BSC and Binance Chain (BC)

BSC came as an extension to BC to support smart contracts and interoperability with Ethereum applications. The idea was to provide both worlds to users, a hybrid with high-throughput transactions and market cap with the programmability and interoperability of the BSC.

What came out is a dual-chain system instead of a layer 2 solution. It does not act on top of the Binance Chain, rather as an independent and complementary protocol to the BC. This system allows users to stake BNB, port ETH-based dapps, and code their smart contracts.

Both networks can act as a cross-chain system —allowing cross-chain communication and cross-chain transfers that allow a flexible and fast infrastructure for users.

Cross-chain Communication#

Here's a list of what you can do with Cross-chain communication and cross-chain transfers

- Create financial products, digital assets, and tokenize your assets.

- Created products on BSC can be traded on BC, allowing a flexible interoperable system where users * can manually exchange their products.

- Users can operate their products in one user-interface ecosystem.

Cross-chain Transfers#

-

When a user makes a transaction to the other blockchain, the transfer-out blockchain locks the amount in a controlled system of smart contracts or addresses. This is an essential aspect for the dual-chain system to work

-

The transfer-in blockchain unlocks the funds from the smart contract/addresses, sending them to the target address.

Dual-Chain Communication##

The two main communication channels are BC to BSC and BSC to BC.

The first channel, Binance Chain to Binance Smart Chain, uses the light client, a program that connects to a full node to allow users to interact with the Binance Chain in a decentralised manner.

The second channel uses an Oracle called Orakuru. Oracles are third-party services that provide smart contracts with external information, bridging blockchains with the outside world.

Oracles keep track and store all data sent to the network like a vault, so communication requests from BSC are executed and adequately implemented into BSC as transactions, which can be viewed and stored on the Oracle, later sent to the BC network.

Orakuru is the BSC community’s Oracle and contains all the essential information of a package (a transaction), such as the sender, the receiver, and the amounts of funds to be transferred.

Every package from BSC is sent to BC after an Oracle Relayer (which is a validator from the Binance Chain) reviews the package. Oracle Relayers are responsible for voting and submitting the package is good to go, and send it to the BC.

Pros/Cons of Binance Smart Chain##

BSC is basically a copy/paste of the ETH ecosystem, only with lower fees and a centralized system. As Ethereum’s high fees skyrocketed, many DeFi users flocked to the BSC system to benefit from the almost exact functionality of Ethereum but without spending expensive gas fees.

Advantages

- Compatibility with Ethereum.

- Interoperability with Binance Chain.

- Support of Smart Contracts and dApps.

- Swaps between BEP-2 and BEP-8 Tokens for BEP-20 tokens.

- Cross-chain communications and transactions.

Disadvantages:

- Centralization: another concern to consider is that BSC is highly centralised. There are only 21 community validators that have control of the network by providing computing power and hardware. Centralised systems are always prone to system failure, attacks by malicious users, regulatory compliance orders, or even hacks.

The problem with BSC’s on-chain governance system is the small community that can slash out other participants. That small community is the one that meets the financial requirements to become a validator. This is why the DeFi-space has criticised BSC for being prone to centralization.

Another problem with these systems is that they are prone to malicious acts if the community with most control decides so. Similar to 51% attacks, caused by miners who have control of the network.

- Subject to rugpulls: BSC has also been subject to most rugpulls in late 2020 and the beginning of 2021. It has been estimated that over 700 rugpulls have occurred in the BSC network. A rugpull is when the main leaders of a project run away with investors' money by abandoning the project.

Conclusion##

BSC can be an alternative for many developers out there. It has been considered the blockchain of the future, despite its disadvantages, by bridging several blockchains with a multi-functioning, highly dynamic cross-compatible ecosystem.

José Oramas

Fintech and finance writer, with keen interest in blockchain and crypto.

See other articles by José

WorksHub

Jobs

Locations

Articles

Ground Floor, Verse Building, 18 Brunswick Place, London, N1 6DZ

108 E 16th Street, New York, NY 10003

Subscribe to our newsletter

Join over 111,000 others and get access to exclusive content, job opportunities and more!